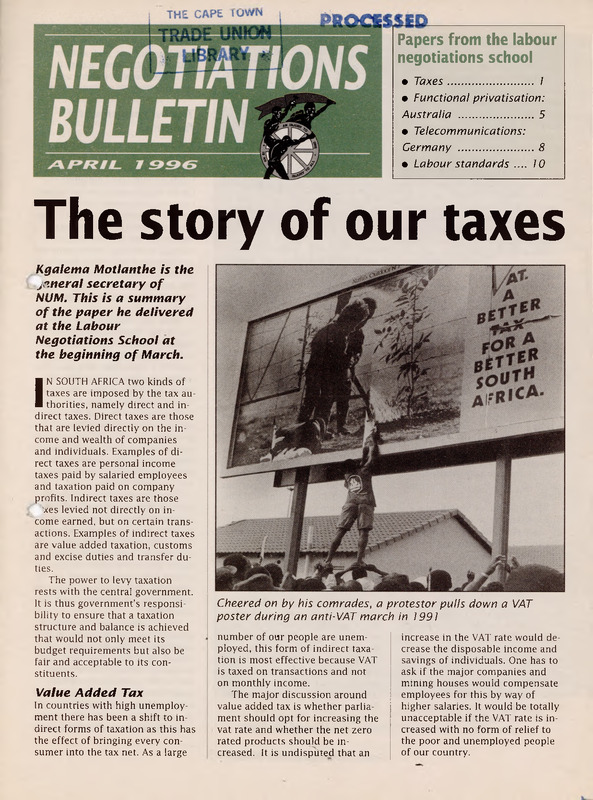

Negotiations Bulletin - The story of our taxes

Item

- Title

- Negotiations Bulletin - The story of our taxes

- Creator

- COSATU

- Date Issued

- Apr-96

- Description

- IN SOUTH AFRICA two kinds of taxes are imposed by the tax authorities, namely direct and indirect taxes. Direct taxes are those that are levied directly on the income and wealth of companies and individuals. Examples of direct taxes are personal income taxes paid by salaried employees and taxation paid on company profits. Indirect taxes are those taxes levied not directly on income earned, but on certain transactions. Examples of indirect taxes are value added taxation, customs and excise duties and transfer duties. The power to levy taxation rests with the central government. It is thus government's responsibility to ensure that a taxation structure and balance is achieved that would not only meet its budget requirements but also be fair and acceptable to its constituents.

- Format

- Language

- English

- Type

- text

- Identifier

- http://hdl.handle.net/10962/137556

- Archive

- Cory Library for Humanitites Research

- Provenance

- The item is held at the Cory Library for Humanities Research, Rhodes University, on behalf of the Labour Research Service

- Extent

- 12 pages

- Rights

- Congress of South African Trade Unions (COSATU)

- Rights Holder

- Congress of South African Trade Unions (COSATU)

- Use/re-use

- The materials are made available explicitly for research and educational purposes. Any use of these materials must be cleared with the Labour Research Service.

- Item sets

- General Materials

New Tags

Position: 12348 (1 views)